Zoho Payroll

Zoho Payroll is a robust payroll processing solution built for all segments of businesses. It is one of the best HR Payroll software, known both as global payroll software as well as a payroll system for small businesses. You can automate your pay runs without any hassle. With a single click, your pay run can be generated.

Features of Zoho Payroll

Feature - 01

Salary Processing

You can create your pay run in a few clicks with a thorough break up of taxes, salary & statutory components.

Feature - 02

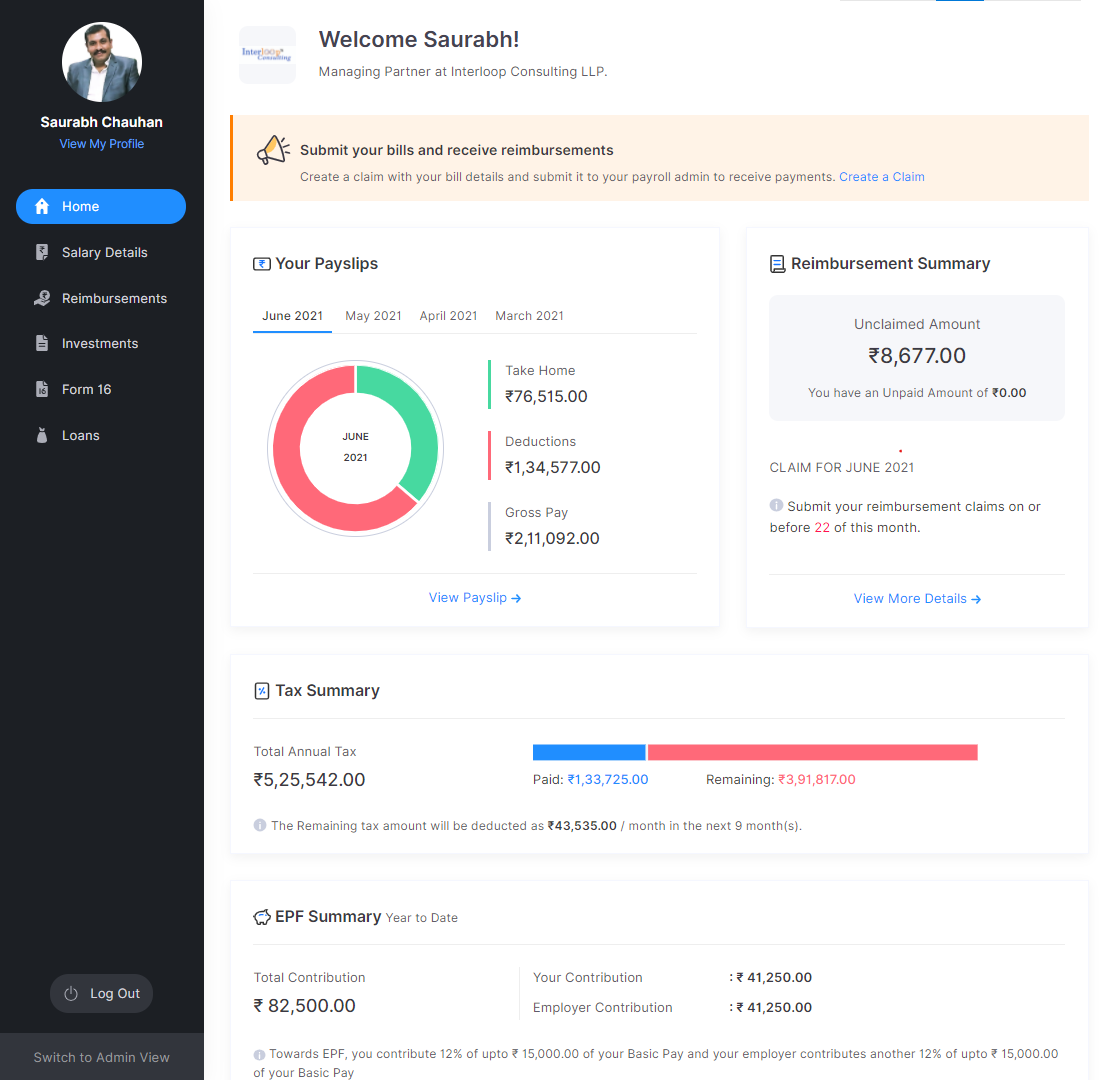

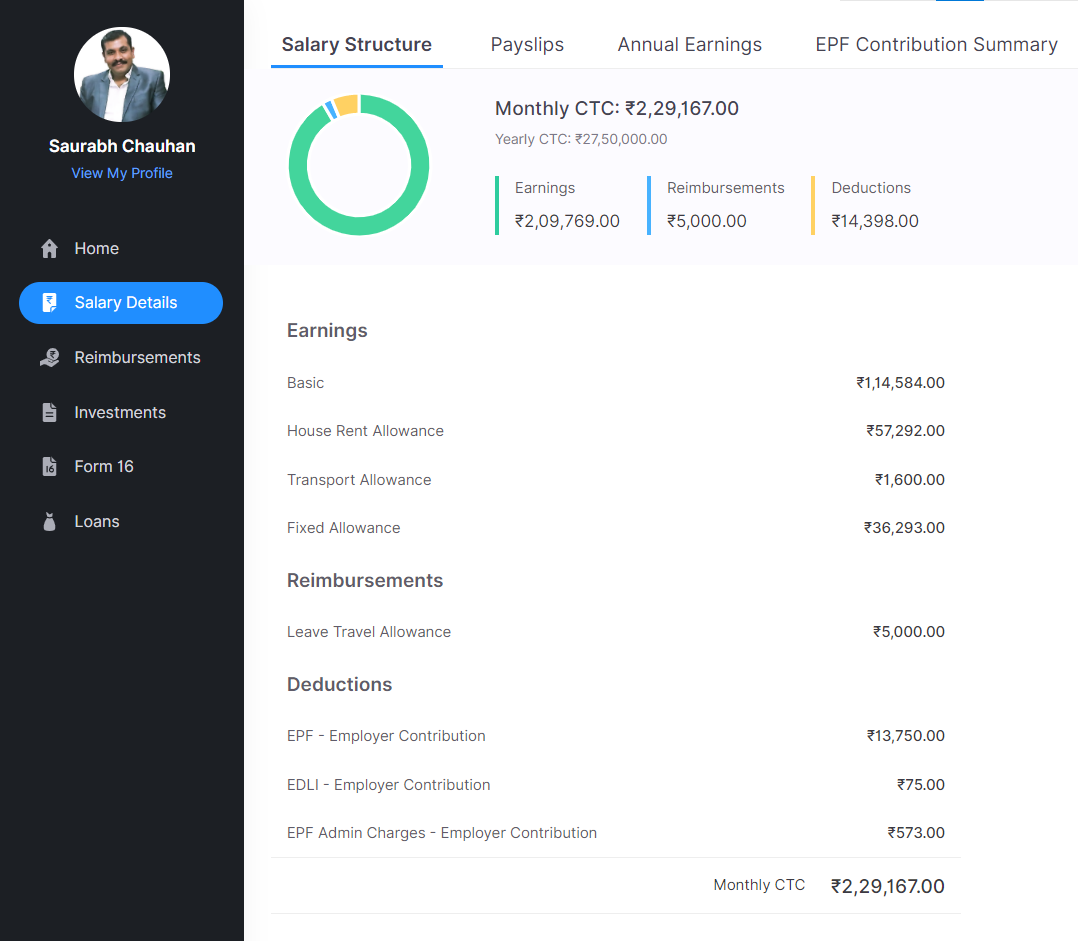

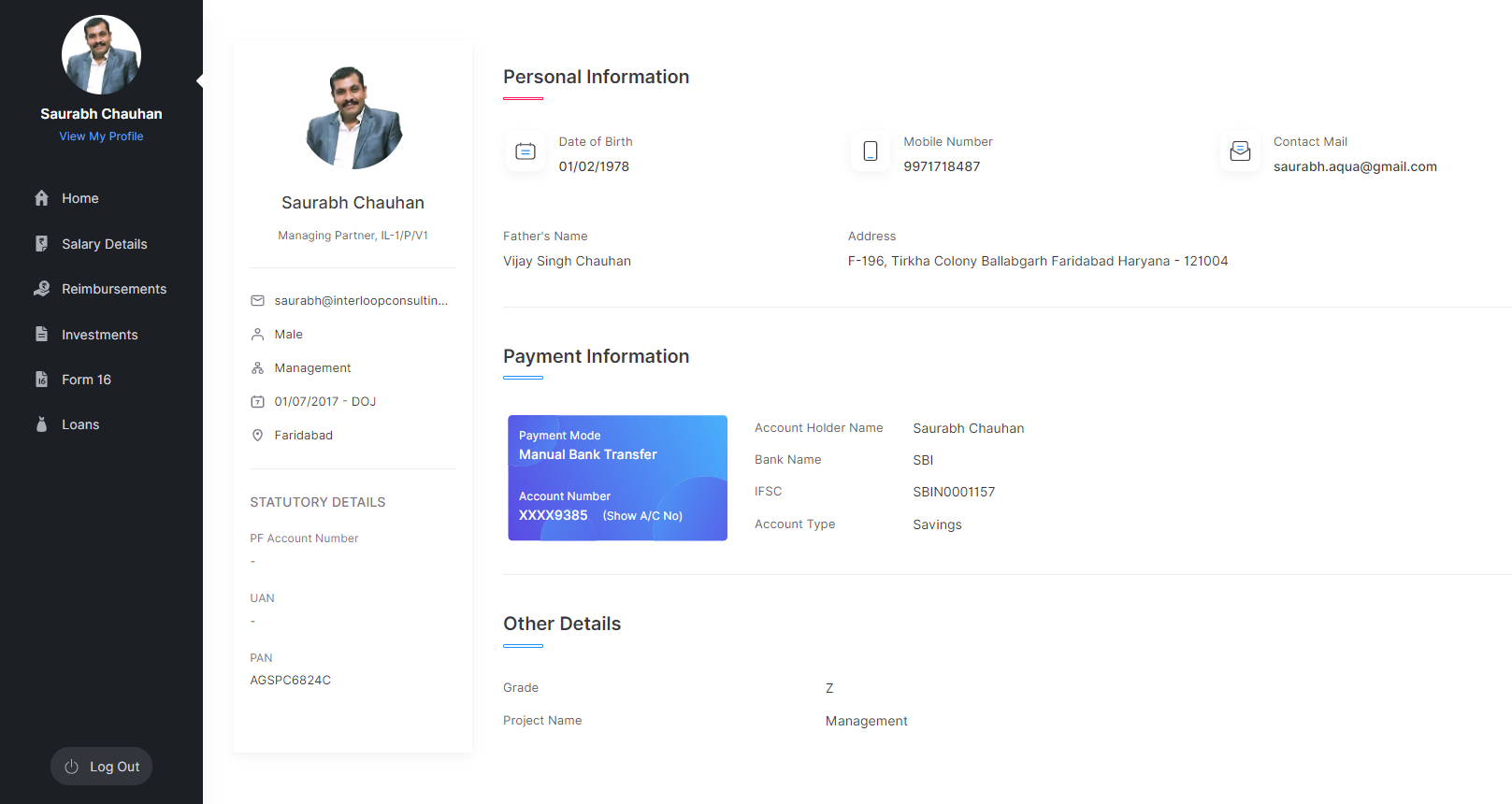

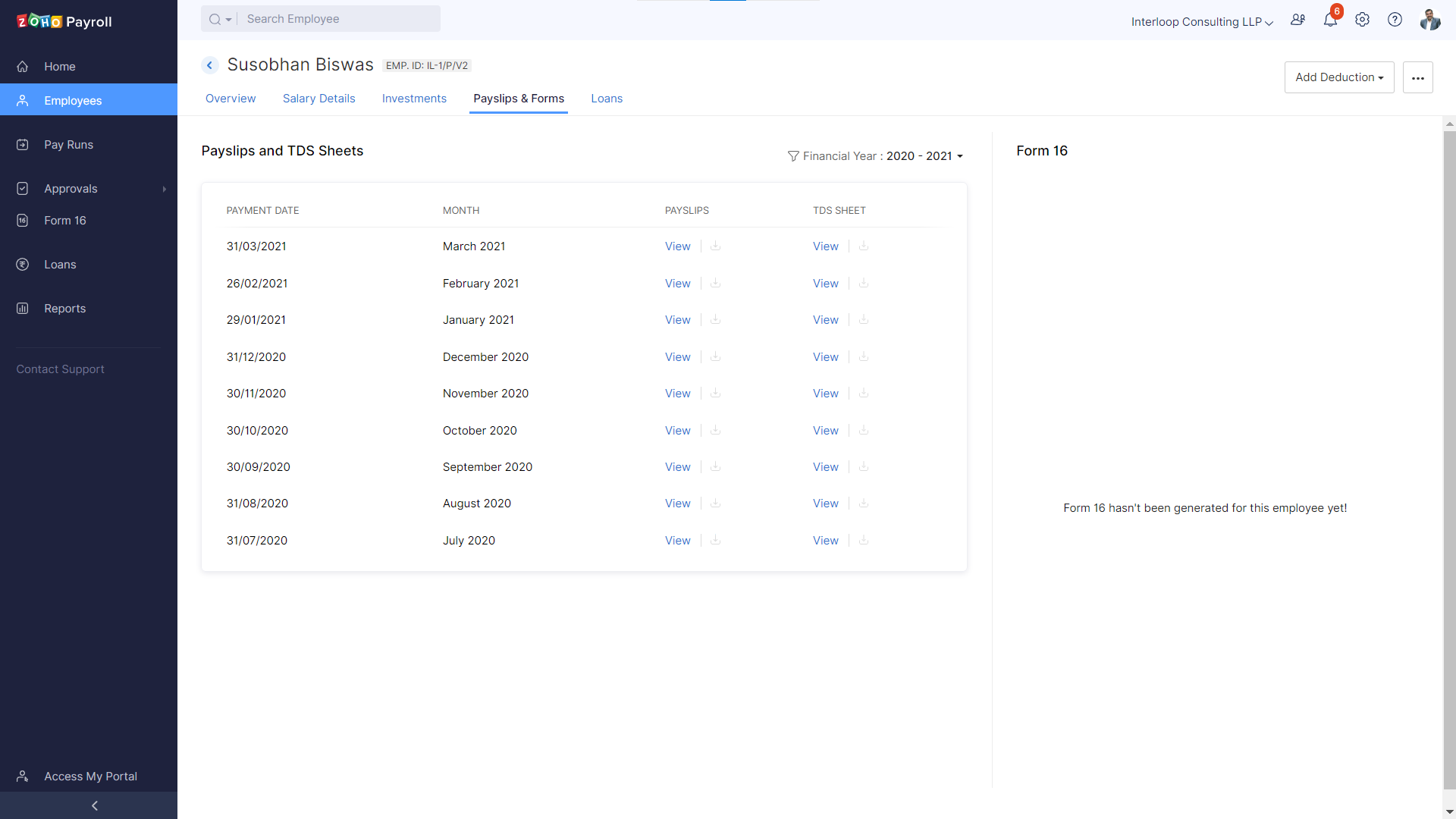

Employee Self Service Portals

Zoho Payroll is a lucrative investment for employee payroll software. You can cut down on time-wasting communications. Employees can download their payslips, Form 16 etc. from their self-service portals. They can submit their investment declarations and proof of investments directly from their portals.

Feature - 03

CTC Reimbursements

You can easily manage CTC reimbursements within Zoho Payroll. Admin Users can approve or reject CTC reimbursements for the employees. Employees can submit these reimbursements directly from their portals.

Feature - 04

Tax Calculations

System automatically calculates Income taxes based on investment declarations and deduct them from the monthly salaries of the employees.

Feature - 05

Form-16

Create Form-16 and release them to employees as and when the time comes. Once released. The same can be downloaded by the employees from their Zoho Payroll self-service portals.

Feature - 06

Investment Declarations & Proof Submissions

Open up and close specific windows for the employees to let them submit their declarations and proof of investments.

Feature - 07

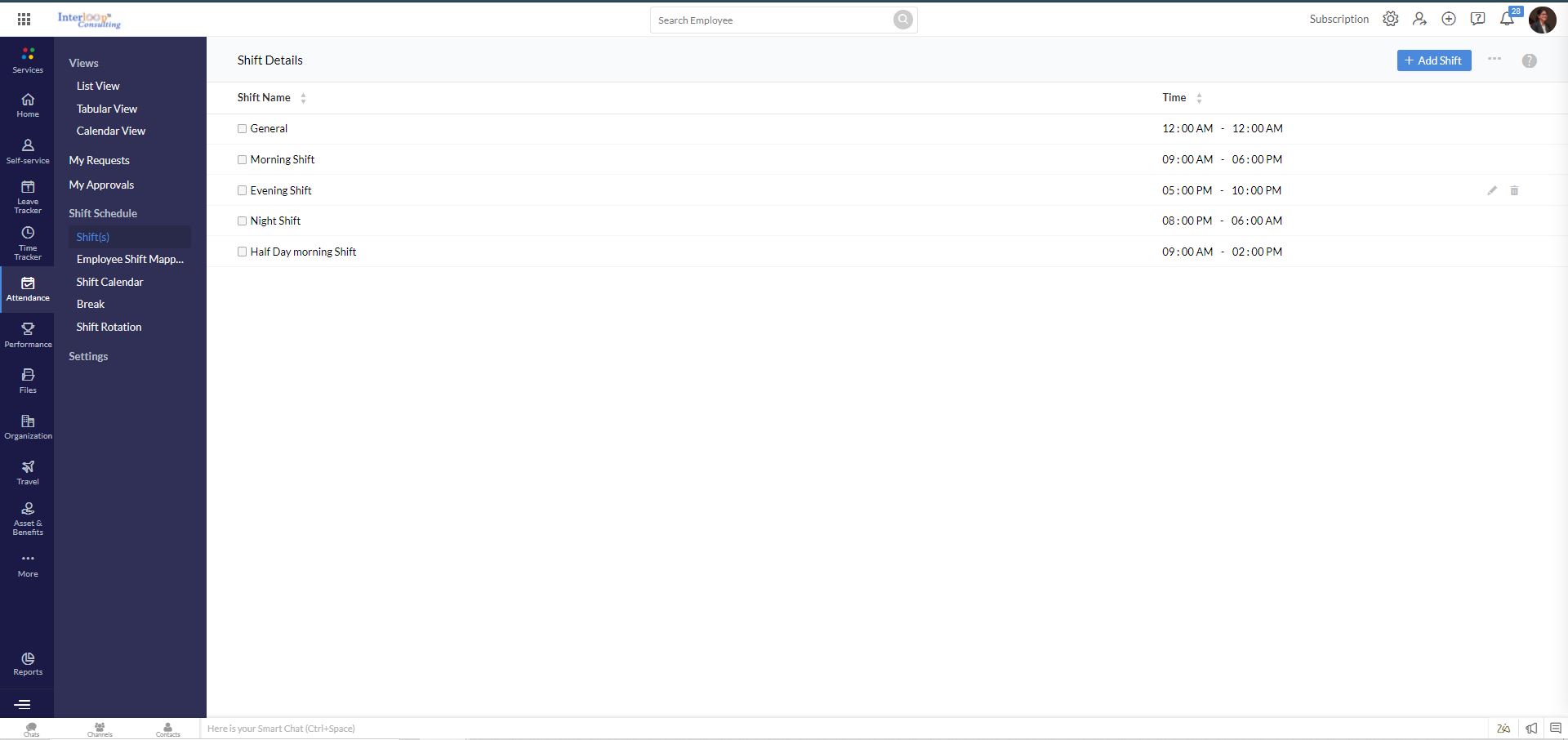

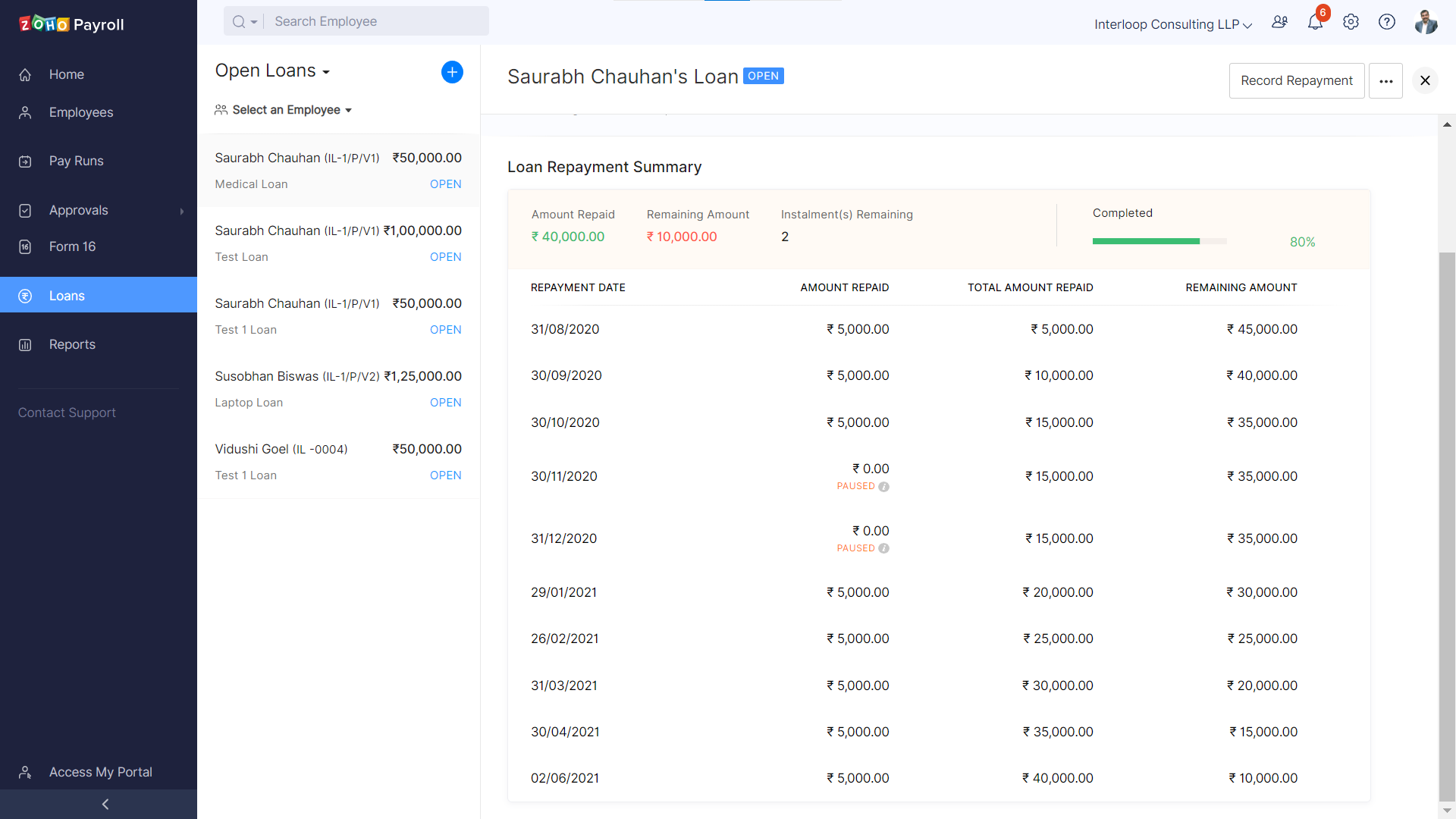

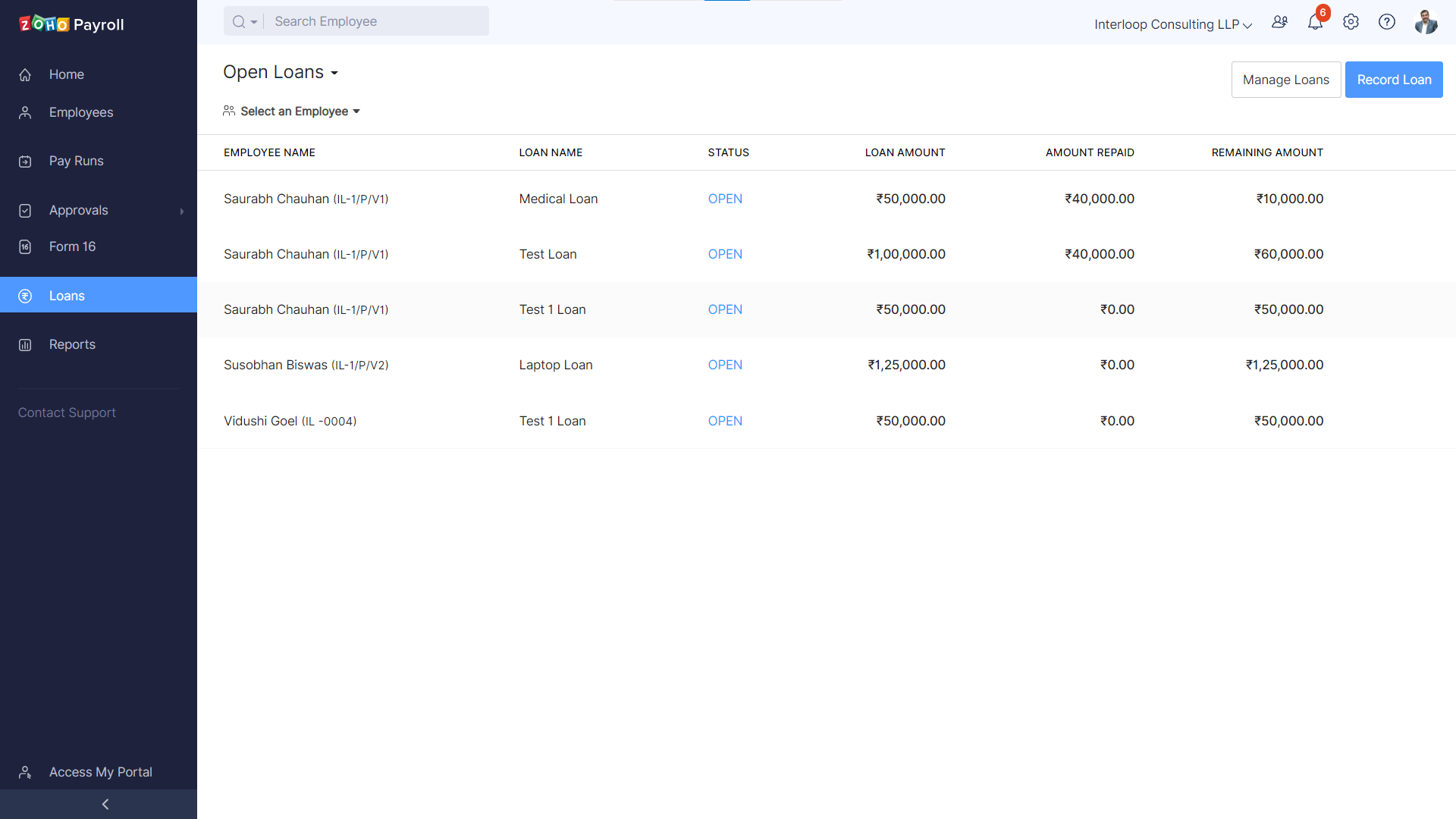

Employee Loan Management

Zoho Payroll helps you manage loans with fewer clicks and automatic deductions of EMIs from the monthly salaries of the employees. The employees can see the balance amount and paid amount for the loan from their Self-Service Portal. It is more than an employee payroll software.

Feature - 08

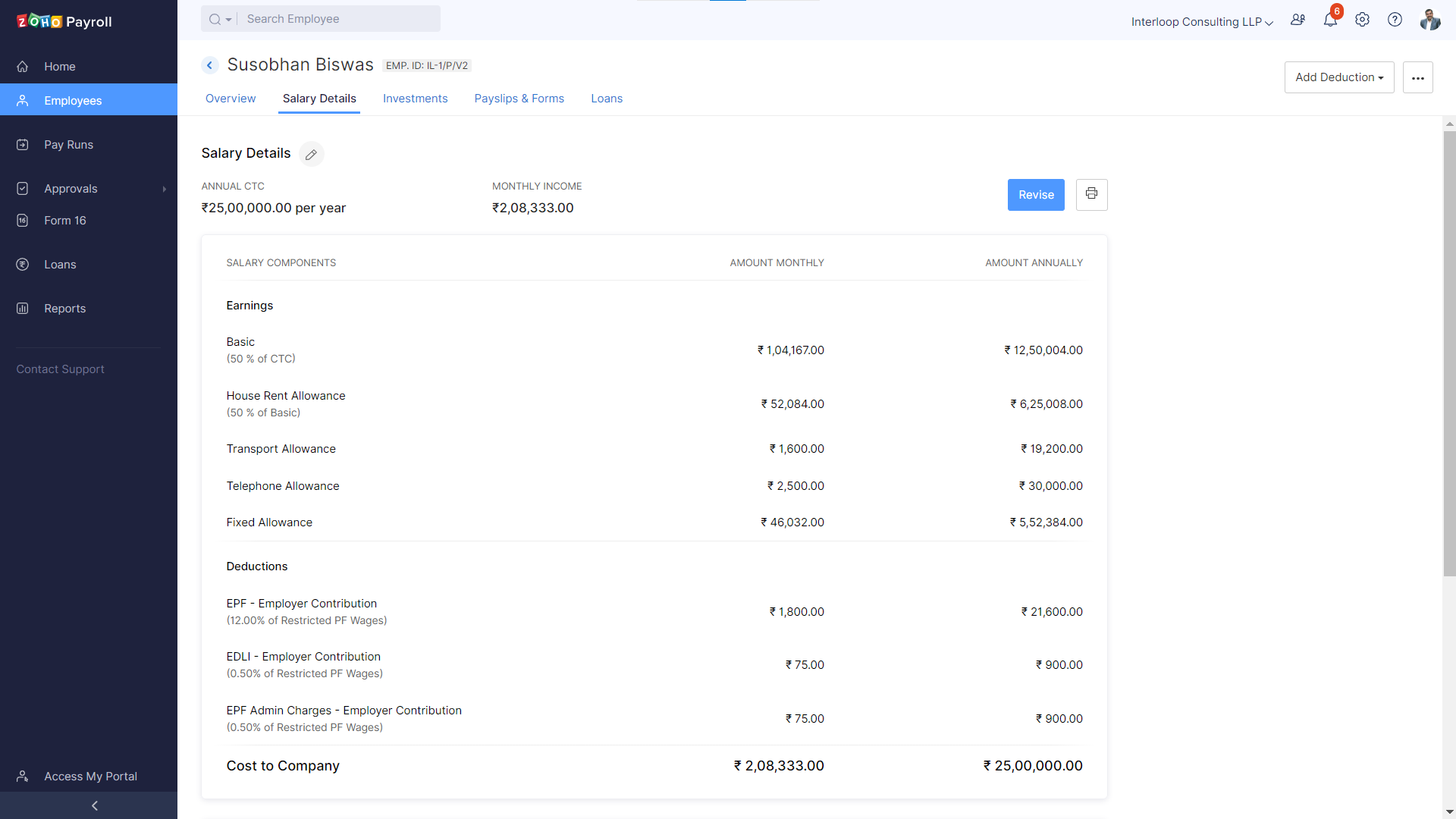

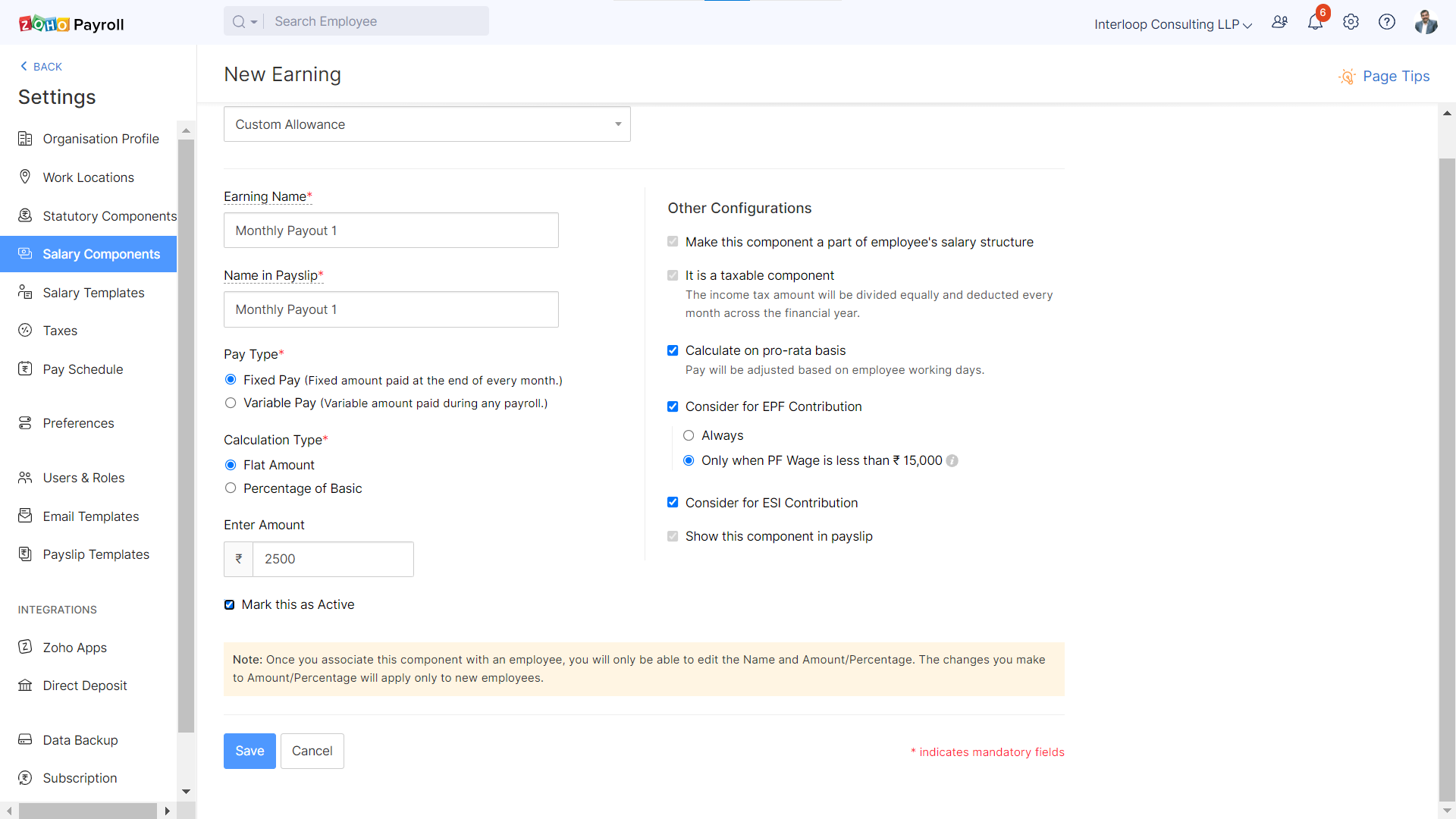

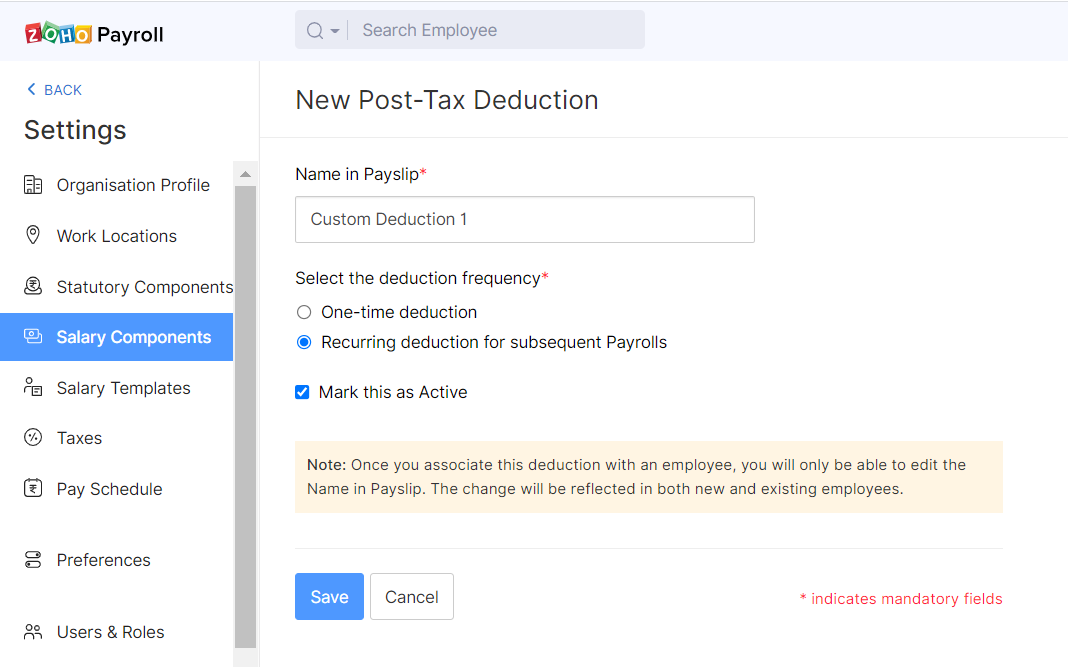

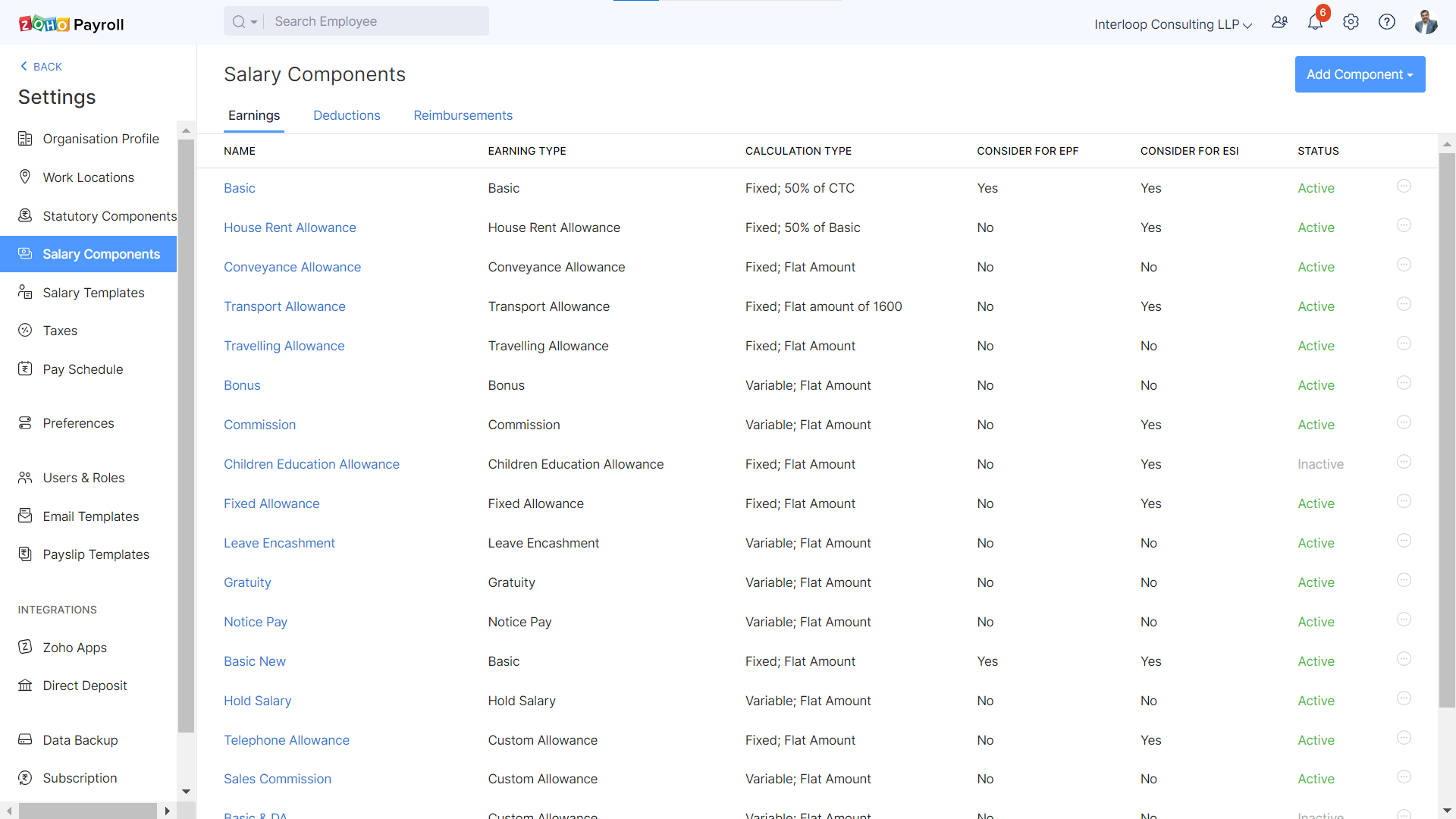

Customized Salary Components and structures

Within Zoho payroll, you can create customized salary components and salary structures as per your salary grades and applicable components. You can create pre-tax and post-tax deductions as and when required.

Feature - 09

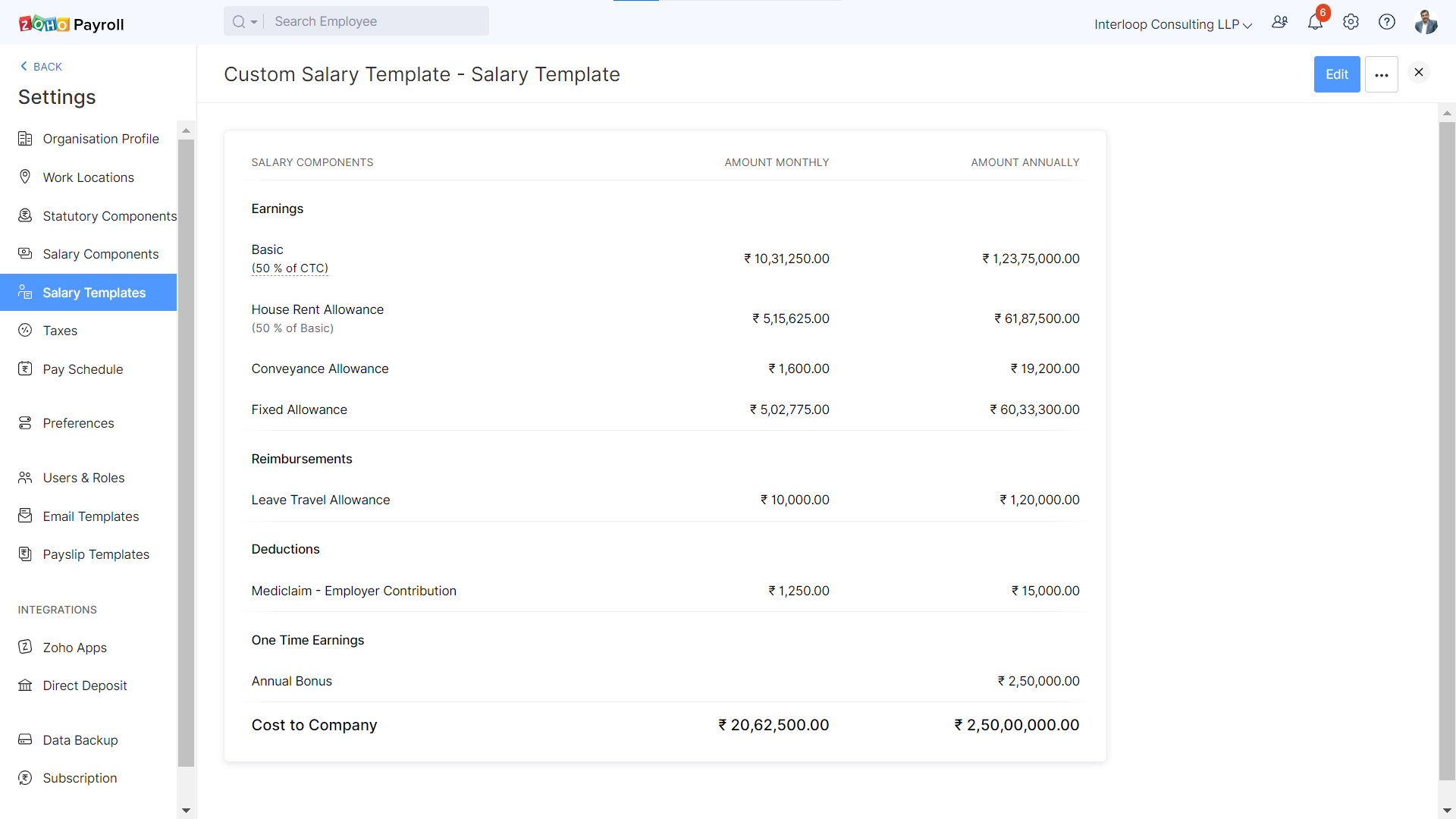

Custom Salary Templates

Custom Salary templates allow you to assign pre-defined salary components to the different set of employees very easily in this HRIS payroll systems.

Feature - 10

Reports

Zoho Payroll provides you with a variety of customizable reports for analytics and compliance purpose.

Feature - 11

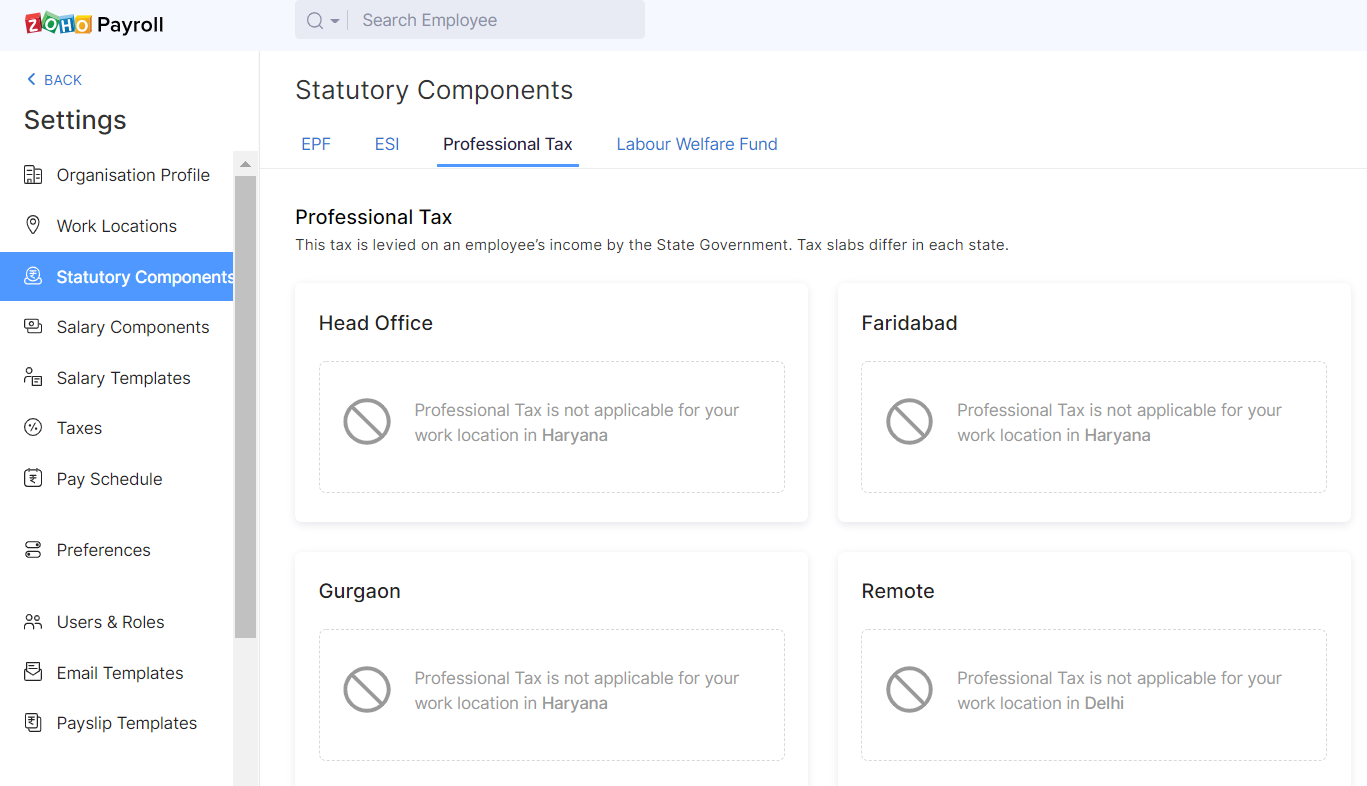

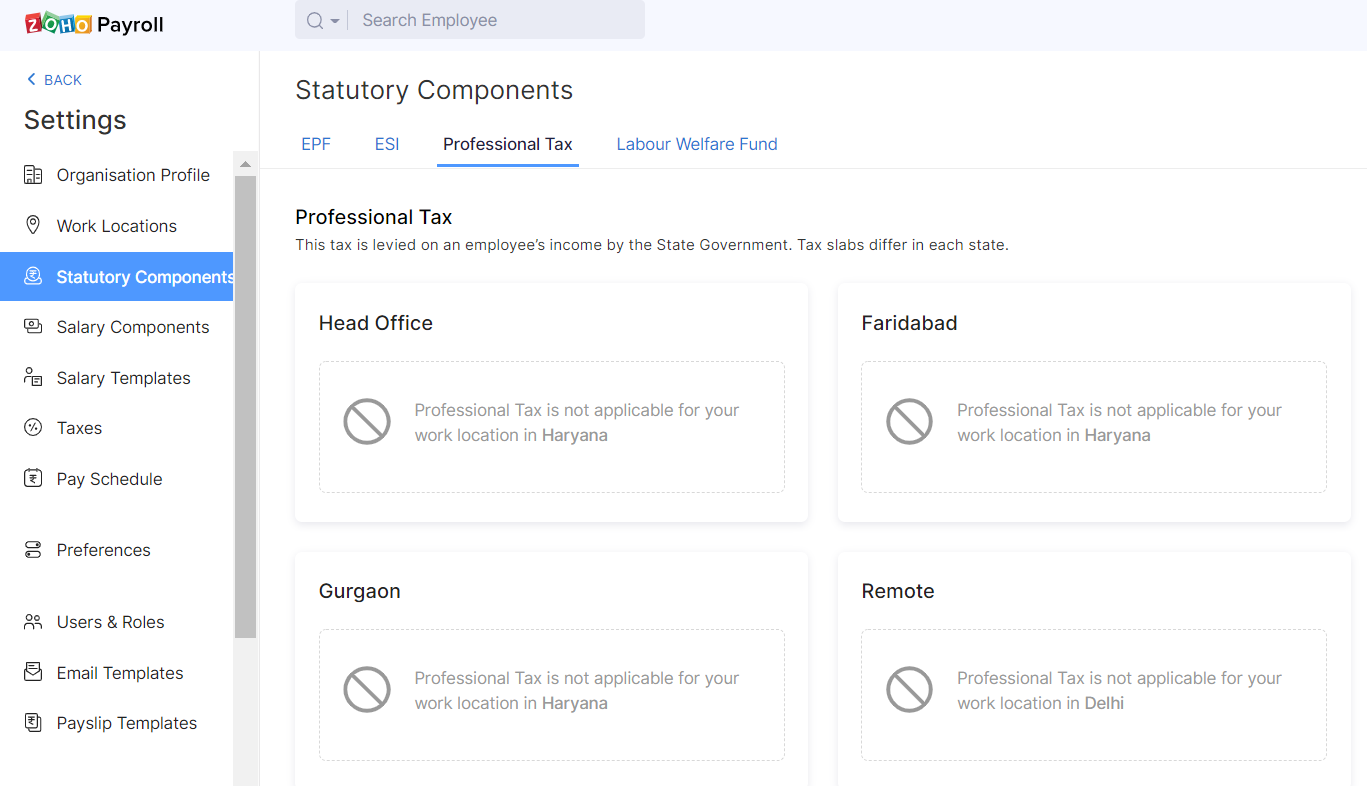

Statutory Components & Reporting

in this Zoho Payroll, you can configure Statutory components (EPF, ESI, LWF and PT) as per the applicability. Also, multiple reports for these statutory components will help you manage compliance reporting.

Feature - 12

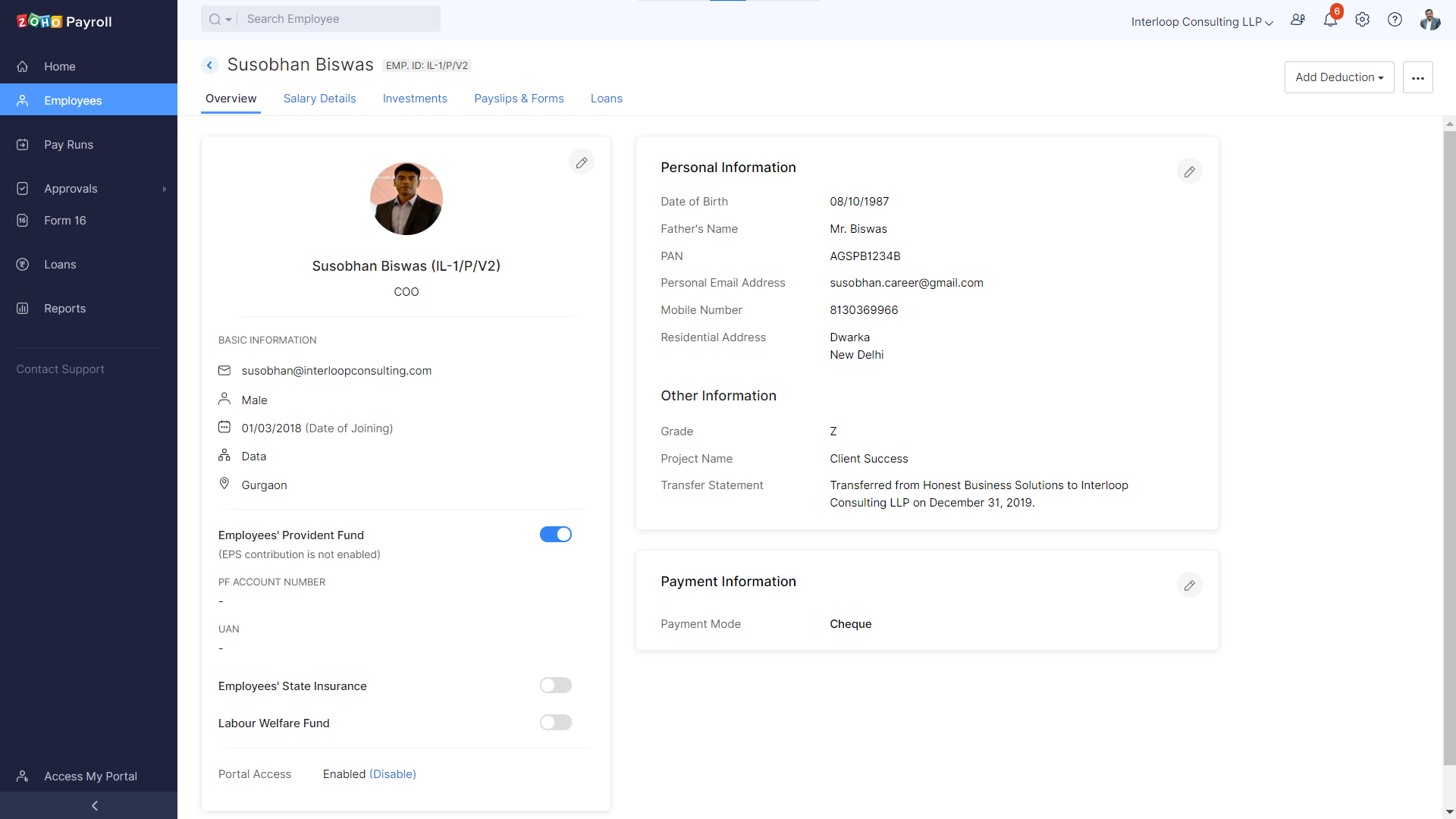

Custom Fields

Zoho Payroll allows you to capture multiple information using custom fields. You will never miss any vital information specific to your employees.

Feature - 13

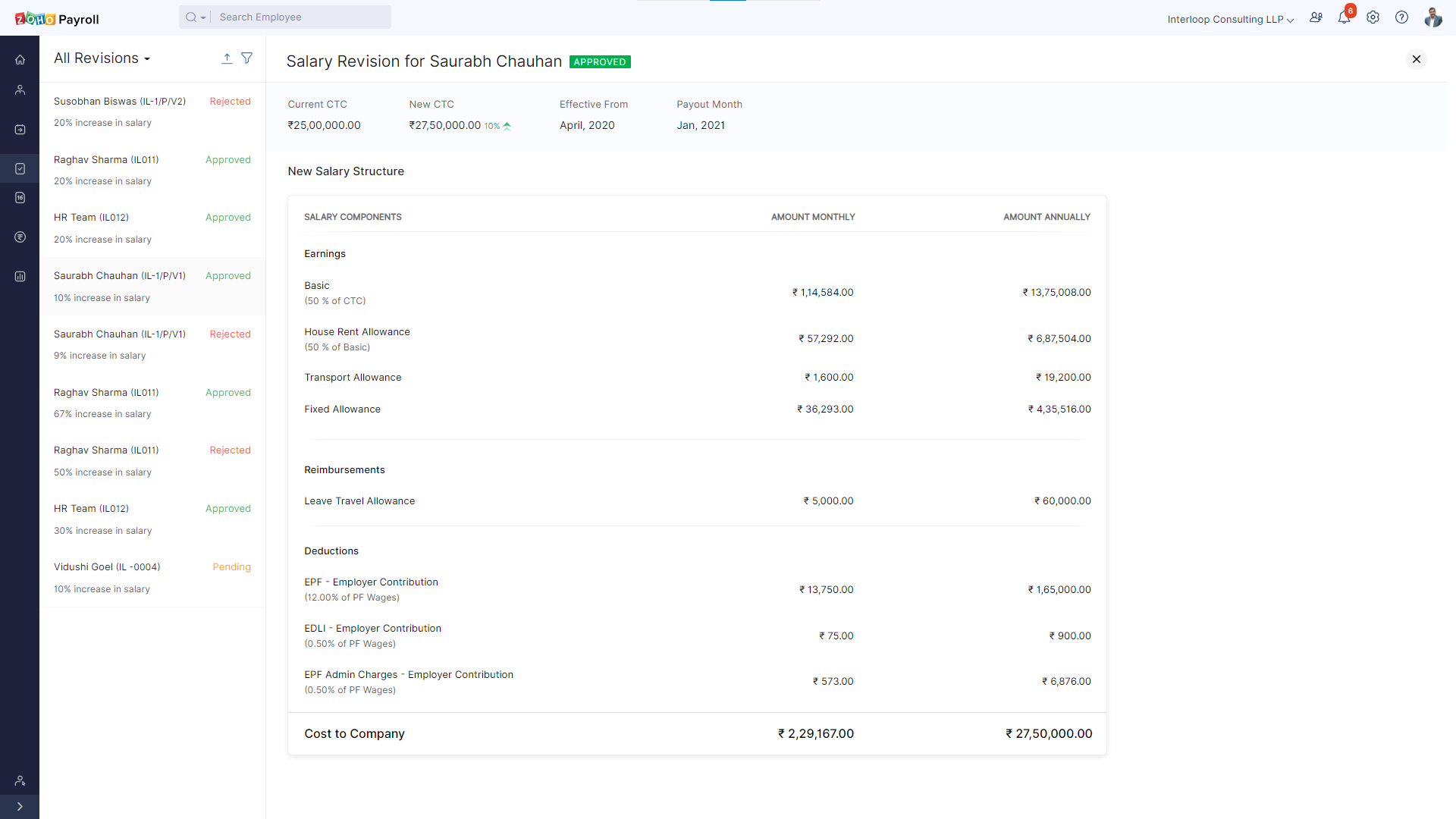

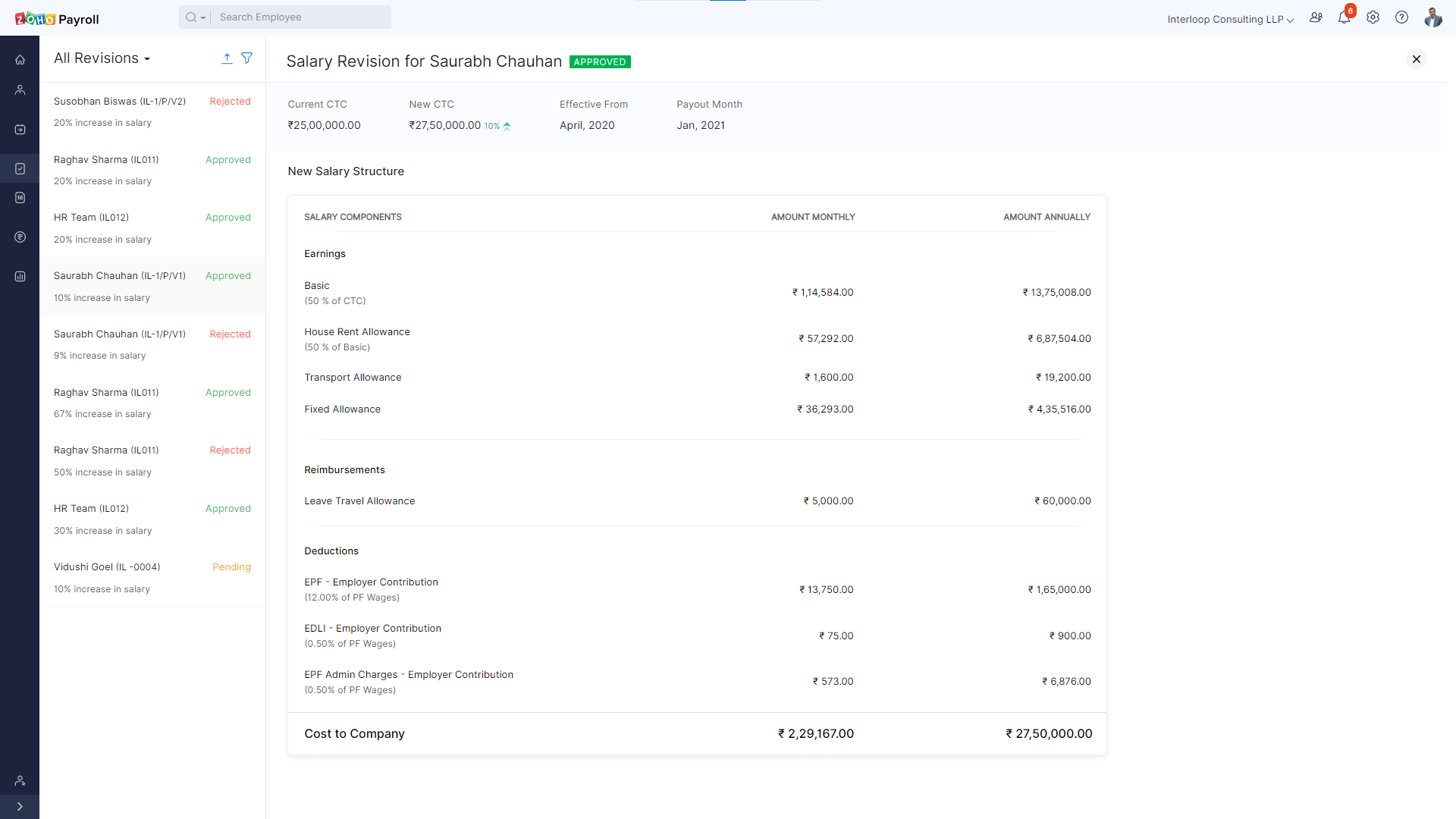

Salary Revisions

Salary Revisions are extremely easy in this HRIS Payroll systems. You can revise the salaries of specific employees or do a bulk salary revision. As required, salary revisions come with the approval to minimize any misuse.

Feature - 14

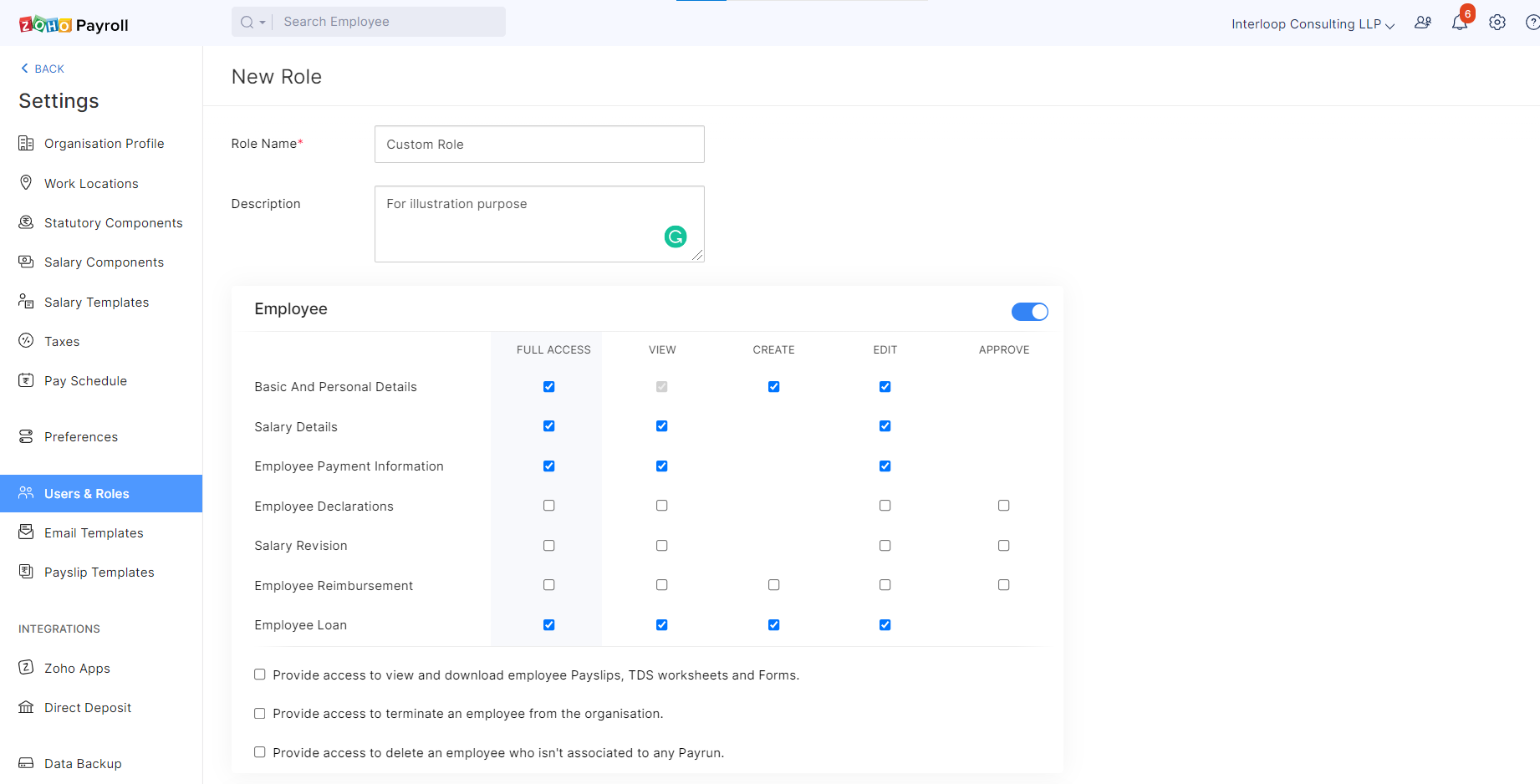

Custom Roles & Permissions

Zoho Payroll keeps security at its forefront. You can design customised access to the different processes of payroll processing. While your Payroll Manager creates and updates the pay runs, your finance manager can approve and disburse the payments.

Feature - 15

Custom features

Bulk Import/export, Salary Hold, Flexible Benefit Plans etc are some features in this HRIS Payroll system that allows you to create a detailed experience at organisational and employee levels.

INTEGRATIONS

greytHR

Paybooks

Zoho People

BRANDS THAT TRUST US

FAQs

As your implementation partner, we analyse your payroll data and help you set it up. We create a custom component, configure them as needed and help you run the pay run for the first two months. We will migrate the data from the start of the current financial year so that your payroll data matches your reported payroll data.

Yes, data can be imported from other payroll software in a format that's compatible with Zoho Payroll. Our dedicated implementation team can guide you every step of the way to import your payroll data successfully.

Yes, Zoho Payroll covers EPF, ESI, PF and LWF configurations accordingly. You can have detailed information in the Reports module.

Absolutely yes. For a monthly free trial and enjoy unrestricted access to all the features of Zoho Payroll. No credit card information required.

The free trial is simply the paid product with all benefits which you can access for a month, after which you are required to upgrade to continue using it. The free plan offers you Zoho Payroll for an unlimited period with a few limitations on the number of employees and some features.

You can opt for either Monthly or Annual billing cycles. Please reach out to sales@Interloopconsulting.com to know more about payment methods.

You will have to purchase separate payroll licenses for each legal entity. If there is only one legal entity and multiple branches of the same entity, then a single license should suffice.

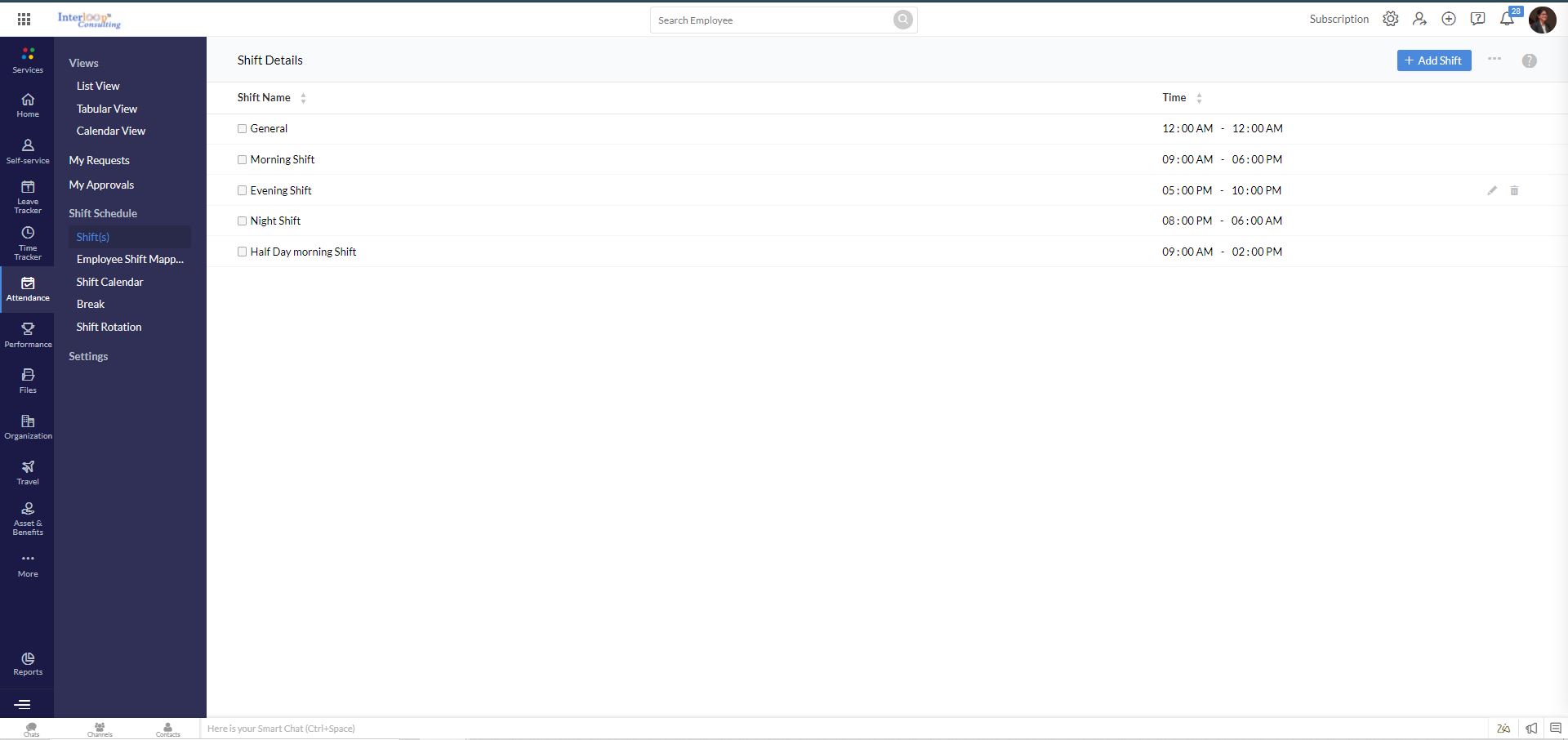

What reports are available in Attendance?

Yes, absolutely. You can have multiple businesses as different organisations associated with your Zoho Payroll account.

Reach out to us at sales@interloopconsulting.com and we'll get back to you at the earliest.